Mining and Net Zero: The Case of Vale

Vale is one of the largest mining companies in the world. This privately-owned Brazilian firm was the world’s top producer of iron ore in 2020, with an output of 300 million tonnes.

On 24 June 2021 Vale announced a revision of its climate pledges, the ‘Carbon Neutral Vale Strategy’. As part of global net zero corporate pledges announced leading up to COP26 in Glasgow in November, the company says it plans to spend up to 6 billion dollars by 2030 on activities in pursuit of carbon neutrality by 2050.

However, how Vale will reach this goal and how the funds will be spent is not clear, since the company has not revised its overall operations or growth plans. Previous pledges made by the company toward ‘carbon neutrality’ identified investments of roughly 2 billion dollars. Vale does describe those investments in detail on its website.

Vale claims they will reduce CO2 emissions by 2030 and Scope 3 value chain emissions by 2035 and then assess how to reduce remaining emissions through the purchase of carbon credits. In other words, Vale will determine if it’s possible to reduce remaining emissions at some point in the future while placing no deadline on that actually happening. Still, the company has taken actions linked to removals and forest offsetting in the past. For example, in 2020, 35,700 tons of CO2 were removed from the atmosphere through the reforestation of degraded mining areas and use of forest offsets.

As part of that ongoing land-sector strategy, Vale pledges to reduce its carbon footprint by 33% by 2030 and reduce 15% of its Scope 3 emissions by 2035. But these pledges are voluntary and they are not reflected in Brazil’s or any other country’s NDC. The question remains, how will the emissions and reductions related to Vale’s commitment show up in the NDCs of countries that host Vale’s operations?

Before describing Vale net zero pledge in detail, it is relevant to highlight two issues:

The last Integrated Report (2020) indicates that Vale has already reduced emissions in the period between 2019 and 2020. But this was primarily due to disturbances in its operations. The company is still dealing with the impacts of the rupture of the Brumadinho dam (MG) in January 2019, one of the largest environmental crimes in Brazilian history. Scope 1 and 2 emissions from that year were reduced 14.9% compared to 2018, and 27.2% compared to 2017. Since sales were also reduced, primarily of pellets and iron ore, Scope 3 emissions dropped 14.6% in 2019, with cumulative reductions reaching 18% from the base year of 2018. See graphs below.

At the same time, the company expects its emissions to peak in 2023, due to an increase in production capacity of about 400 metric tons per year of iron ore. And so, it appears that Vale will start to actually reduce emissions only after 2023.

Graph 1: Emission reduction goals for Scope 1 and 2 emissions

Source: Data from Vale’s Carbon Neutral webpage; graph by FASE-Brazil. The green bar represents ‘Business as Usual’ growth of emissions, if output increased without per-unit decreases in emissions.

In 2019, the company registered a total of 12.6 million tons of CO2 scope 1 and 2 emissions. Scope 1 emissions are from Vale’s operations—direct consumption of diesel natural gas, and coal. Scope 2 represents emissions associated with Vale’s purchase of electric power or steam. Vale has said to be aiming for a reduction and a limit of 9.5 million tons of CO2 emissions by 2030, as can be seen in Graph 1.

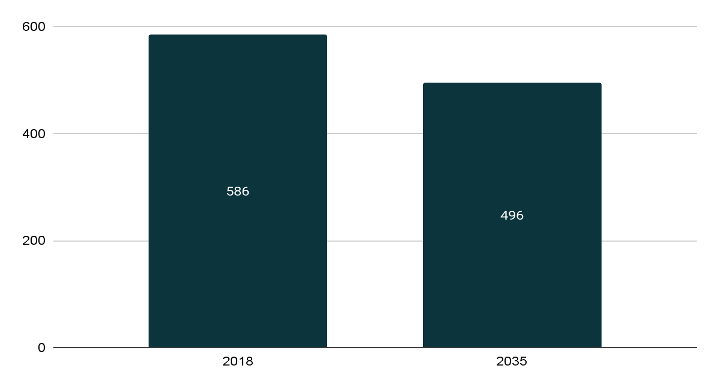

As for Scope 3 emissions—from Vale’s value chain—it adopted 2018 as its base year, when it measured 586 million tons of CO2 equivalent. The company plans to reduce emissions to 496 million tons of CO2e in 2035, as seen in Graph 2—a fifteen percent decrease from the Base Year.

Graph 2: Vale’s Scope 3 emission reduction goals

Source: Data from Vale’s Carbon Neutral webpage; graph by FASE-Brazil.

The company states it will reach its 2030 emission-reduction goals in two main ways: through the adoption of carbon pricing for capital projects, and through evaluation of its businesses in relation to different climate change scenarios in Strategic Planning. To develop its net zero strategy, Vale created the Low Carbon Forum to set and oversee the implementation of initiatives. On its website, Vale lists a series of initiatives that are or will be implemented in the near future in order to achieve the goals it has pledged:

Self-sufficiency in renewable energy, including 100% renewable sources for generation by 2030;

Replacement and electrification of current diesel consumption in mining and transportation activities;

Restoration and protection of 500,000 ha of degraded forest area by 2030, in Brazil and abroad, through investment in avoided deforestation, improved management, mitigation, and restoration.

How does Vale understand ‘restoration’? It isn’t described or defined in the company’s Carbon Neutral Strategy. Historically however Vale has developed large-scale palm and eucalyptus plantations, while also participating in Clean Development Mechanism [CDM] projects that include both restoration and afforestation. It also spun off a company, VALE Reflorestar S.A, that invested in restoration and plantation development. This fund was sold to Suzano Papel e Celulose in 2014.

The company also plans to offset residual carbon emissions—or rather, emissions the company claims cannot be avoided as part of its expansion plans.

With these pledges, Vale goes to great lengths to show society and investors that its activities benefit the environment, and that the company is an ally in combating climate change. These pledges should be evaluated in light of the damage that Vale’s activities have caused in Brazil and in other countries [see Box below]. Not only that, but it also shows over time and around the world where Vale operates, adaptation strategies were by the company were flawed and not able to minimize or prevent damages.

Vale notes on its website that it protects 8,500 km² of land, of which 4.5% is fully owned by the company and consists of legal reserve areas and properties intended for conservation. These lands are listed as part of Vale’s work in biodiversity conservation. The company has created a 23,000 hectare ‘Vale Nature Reserve’. The Vale website states that protecting the forest is an activity carried out in a partnership with the Instituto Chico Mendes de Conservação da Biodiversidade (ICMBio).

Vale claims that it is only through its actions that the forest is being preserved. Unmentioned are the damages that mining activities have caused to the environment—directly or indirectly, via deforestation or contamination of soil, water or air.

Actually, Vale stated this year that it will divest from investment in coal, and will also withdraw previous requests made to Brazil’s National Mining Agency (ANM) to mine in indigenous lands. However it appears that Vale will maintain its enormous investment in a coal mine at Moatize, Mozambique.

The main question remains: how do the emissions and reductions related to Vale’s commitment show up in the NDCs of countries that host the company operations? There is no discussion of this issue in any of Vale’s reports. With these pledges, Vale hopes to retain its competitive advantages, its attraction to ESG investors, and its ‘social license to operate’. [It has tried to put some distance between itself and the Bolsonaro government, in order to retain favor from international investors.]

But this is a company with a long history of socioenvironmental crimes. There is no proposal from Vale for reducing the scale of its destructive mining activities. To avoid conflicts and the criticism of its socioenvironmental impacts and indigenous and traditional people rights violations, Vale is using its ‘net zero’ climate pledges as the core of a green marketing effort.

Environmental Disasters resulting from Vale’s activities

Brumadinho (2019)

In January, the dam Mina do Feijão collapsed killing 270 people with 11 still missing. The dam dropped 14 tonnes of mud and iron tailing downhill, destroying the land in its way and killing the Paraopeba River.

Mariana (2015)

In November, the dam of Fundão broke killing 19 people and letting loose 43.7 million cubic meters of mud, leaving many people without a home or a way to provide for themselves, and polluting the Rio Doce all the way to the ocean.

Nova Caledônia (2014)

An acid effluent leakage from one of the company's headquarters, located in the archipelago in a river, killed approximately a thousand fish.